Following up on my post from last week, I wanted to continue with the idea of creating a system of income a little further and offer a word of warning. Often when I teach someone about systems of income and suggest they work on starting a business, they promptly tell me that they have already tried that, and it didn’t make them wealthy. In fact, it left them in a much worse financial position than before starting the business. I then ask them if they actually started a business or if they were self-employed. Without exception, their response is, “What’s the difference?”

In fact, there is a very big difference between owning a business and being self-employed. Owning a business means that you own a system of wealth creation. You have some way of making money regardless of whether you actually show up to work every day or not. Your system can be machinery, automation, employees, outsourcing, investments, computer programs, etc., but the key is that it works independently of your direct daily input. On the other hand, someone who is self-employed buys themselves a job. They exchange their time for money as the owner and operator of their company.

Perhaps a story will help illustrate this point. John Doe is an accountant. He works very hard for his firm and brings in many new clients each year. In December, he receives his normal paycheck and a nice bonus for his good work. Being an accountant, John knows his bonus is a mere pittance compared to what he made for his employer. He feels like he should receive more of the income he created, but his employer doesn’t see it that way. He is paid according to the terms of his agreement, independent of his work output.

John has felt frustrated for quite a while with his overbearing boss, and a lack of freedom to spend time with his kids. Now, feeling like he is being short-changed on his compensation for his hard work, he’s had enough. He quits his job one Friday afternoon to go out on his own and form his own practice. He’s going to show his old bosses just how valuable he was.

Sound familiar? You probably know a plumber, contractor, roofer, accountant, engineer, doctor, or other professionals who set out on their own to start a “business” and be their own boss. We are all a bit envious of their courage and chutzpa for going it alone. What we don’t often see is the journey that those brave souls go through to try and make it work.

At first, John is excited and ambitious in his new company. He quickly lands a good account with a long-term client and sets to work building his little empire. He is laser-focused on building up his clientele and meeting his customer’s expectations. He is a one man show so he has to work extra hard to complete the daily tasks for his clients while also handling the additional responsibilities that used to be managed by his office staff back at his old firm. His nights and weekends are now filled with billing, sales calls, ordering stationery, fixing the printer, calling a client about a past-due invoice, etc.

Unsurprisingly, after six months of this grind, John starts to feel pretty tired. He is making more money, and his business seems to be growing, but he’s still missing his daughter’s class play and he hasn’t been to a single little-league game this season to watch his son. He tells himself that everyone has to work hard when they first start a business, so he pushes on, working even harder to break through the startup barrier.

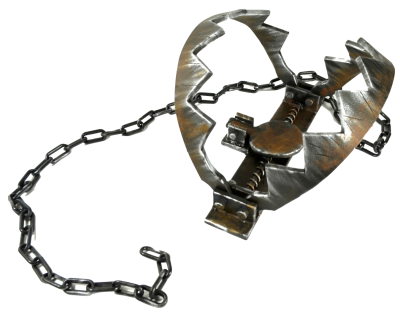

John has entered what I call the self-employment trap. Like the Bermuda Triangle, many self-employed people wander in unknowing and never make their way back out. If John doesn’t figure out how to get out of the trap, he will soon find himself lying sick in bed from exhaustion and a weakened immune system, ready to shut down his business. His dreams of becoming rich will go up in smoke as he realizes that the extra money isn’t worth the stress, missed family time, and frustration of running his own company. Unfortunately, he will also conclude that starting a business is really risky, and only those who are lucky are able to get rich. He is done taking that risk and knows without a doubt he will make sure his kids buckle down in school so they can go to college and get a good job and not make the same mistakes he did.

John won’t believe me, because he lived through the pain, but his conclusions are all wrong. He is blaming his woes on the wrong things. The problem is not that business is a game of chance, the real problem is that John never actually started a business. Instead, he fell into the self-employment trap.

So what is this trap? It starts out innocently enough as the hard work required to get a company started. An accountant has to do the accounting work for his first client because there is no one else around to do it. This hard work is multiplied by the owner/operator managing all of the administrative tasks of a business as well. This is perfectly normal in the early stages of a company and many of us (unless we have a nice trust fund to use as a funding source) will start our companies as a solo operation where we do most of the work. This is the grunt work required to grow a business. The trap occurs when we are so absorbed in daily tasks that we fail to spend any time figuring out how we can turn our processes into a system. In other words, we continue to act like employees and not like business owners.

I love the way that Robert Kyosaki teaches this concept in his book Rich Dad’s Cash Flow Quadrant: Guide to Financial Freedom. He teaches us that employees have a job, self-employed people own a job, and business owners own a system of wealth creation (paraphrasing here, I apologize if I slaughtered that too badly). The key to avoiding the self-employment trap is to make sure that our main focus in our company is to create a system. Without a system of wealth creation, the self-employed individual will be trading their time for money for the rest of their lives, just like they did as employees, and they will never enjoy the freedom of time and true wealth they set out to achieve when they quit their jobs.

As with all Wealth Mentality principles, this is easier said than done, but here are a few suggestions to get you started on the proper thought processes.

The self-employment trap is out there for all of us to fall into, so we need to be aware of it and push past the danger when it arises. Starting a company as a one-man-show is fantastic and appropriate for many of us. Just make sure that you avoid the trap and stay focused on turning your company into a business. Alternatively, if you can figure it out, start your business with a wealth-creation system from the beginning and skip the self-employment path completely. Either way, the system is the key, and that is the Wealth Mentality Way.